CLAI Ventures Invests in Rhizome: AI for Climate Adaptation and Resilient Grids

CLAI Ventures is pleased to announce our latest investment in Rhizome. As extreme weather events intensify, electricity demand rises, and renewable and distributed energy resources proliferate, the need for a smarter, more resilient grid has never been greater. While climate tech funds have historically focused on climate mitigation, we believe the time is ripe to invest in climate adaptation solutions, especially those enabled by AI. And when it comes to adaptation, we believe the biggest pain point worth solving is reducing the risk of wildfires started by grid infrastructure during extreme weather events.

The Urgent Need for Grid Hardening

Wildfire seasons are lengthening, heat waves are intensifying, and severe storms are becoming more frequent. Each of these trends drives more outages, equipment damage, and safety hazards for customers and first responders. Consider two recent examples:

Maui, August 2023: Fueled by severe drought and hurricane-driven winds, the Lahaina fire spread rapidly, destroying over 2,200 buildings, decimating the historic town center, and costing at least 102 lives. Investigators concluded that downed power lines—knocked over by high winds—ignited dry brush, transforming a small ember into an inferno.

Los Angeles, Early 2025: At least one of the devastating wildfires has been traced to utility infrastructure failures. Blown-down or improperly de-energized lines sparked flames that raged through dry vegetation under high-wind conditions.

These tragedies underscore the imperative for grid resilience. Federal programs, such as the Infrastructure Investment and Jobs Act, now commit billions of dollars to grid-hardening initiatives. Meanwhile, regulators, like the Connecticut Public Utilities Regulatory Authority, require utilities to demonstrate a clear “value of resilience” metric before approving new spending. Recent liabilities are stiff: PG&E’s historic $13.5 billion settlement for California wildfires, which forced the company into Chapter 11, vividly illustrates the existential risk utilities face if they fail to invest in resilience.

How Rhizome Addresses This Need

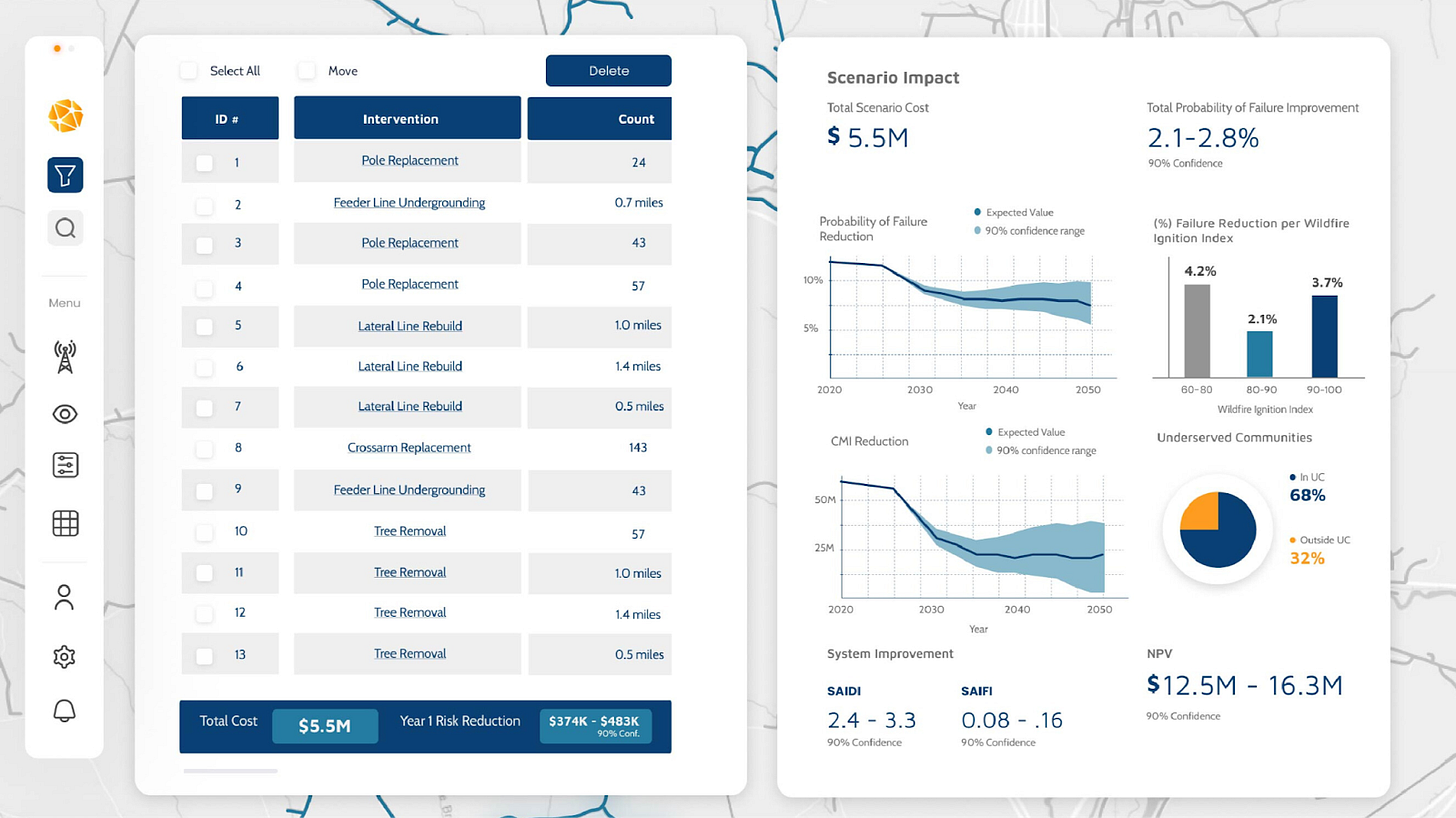

Rhizome stands at the forefront of grid-resilience technology. By combining AI and machine learning with geospatial, asset-level, and historical outage data, they provide utilities with a unified platform to quantify and prioritize resilience investments. Their founders—Mish Thadani and Rahul Dubey—have built a robust, data-driven approach that:

Integrates Climate Projections with Infrastructure Data

• Models future extreme weather scenarios (wildfires, heat waves, floods, severe storms) at an asset level.

• Translates risk into “value of resilience” metrics—showing regulators and utilities how each dollar spent reduces future losses.

Enables Granular, Cost-Effective Interventions

• Identifies high-risk assets that may benefit most from modest upgrades—such as adding a single smart sensor or sectionalizer on a feeder in a wildfire-prone canyon—versus costly line rebuilds.

• Assesses a broad range of resilience measures—asset replacement and hardening, vegetation management, distribution automation, and integration of distributed energy resources.

Builds on Foundational Research & Utility Partnerships

• Leverages resilience research from national labs and proprietary machine-learning algorithms.

• Already partners with Seattle City Light, Vermont Electric Power Company (VELCO), Avangrid and other utilities, demonstrating major traction and strong industry trust.

Why We’re Excited to Back Rhizome

At CLAI Ventures, we support founders who use AI technology to reshape climate-critical infrastructure. Mish and Rahul combine technical expertise, systems thinking, and deep utility relationships to address a critical gap: making grids climate resilient and minimizing wildfire risk. Upon meeting Mish during the MIT Energy Conference in March ‘25 at a Climate Adaptation panel, we were blown away by their traction with utilities, one of the hardest segments to sell to. Given their value proposition it was clear how they are solving a major pain point that will continue to drive incoming demand from utilities. CLAI Ventures is excited to support them on this $6.5 million round led by Base10 Partners.

We believe Rhizome’s platform will become indispensable for utilities seeking to optimize resilience investments and meet evolving regulatory requirements. Please join us in welcoming Rhizome to our portfolio. We’re proud to back their mission and look forward to their continued growth as they help utilities build smarter, safer, climate-resilient grids.